This video will explain what the purpose of form 8655 is and will hopefully answer any questions you may have form 8655 allows our firm to prepare and sign federal employment tax returns electronically for our clients the form you're looking at is a sample client so we can explain the form the 8655 will be sent to you during the payroll setup process once you receive the form please review and sign the form in a timely manner so there are no delays for the first payroll run the form must have a wet signature in Black Ink No e-signatures can be accepted review the document to be sure your address and contact information is correct at the bottom of the page you will sign where indicated fill in your title and date once that is completed please scan the document and send it back to our firm you can email the form to payroll marsco.com please do not take a picture of the paper and send that in our system will not accept it if you do not have scaling abilities you can mail the form to our office if you have further questions please call our office at 724 -898-3555 or send an email to our payroll department by emailing payroll marsaco.com.

Award-winning PDF software

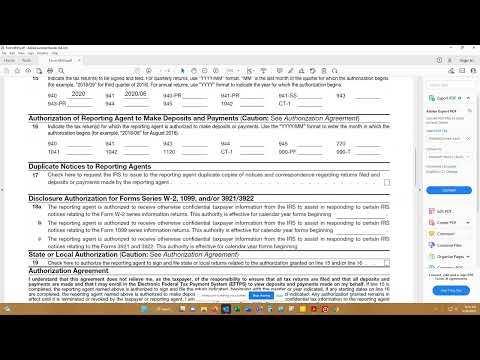

How to prepare Form 8655

About Form 8655

Form 8655 is the Reporting Agent Authorization form, and it is used by taxpayers to authorize someone else (the reporting agent) to file and submit tax returns on their behalf. Generally, businesses with multiple locations or those needing assistance with tax filing or payments may use a reporting agent. The form is also used by the reporting agent to notify the IRS that they have been authorized by the taxpayer to act as their agent.

What Is Form 8655?

Online solutions help you to arrange your file administration and strengthen the productivity of the workflow. Follow the brief guideline in an effort to complete Irs Form 8655, avoid errors and furnish it in a timely manner:

How to fill out a 8655?

-

On the website hosting the document, click Start Now and pass to the editor.

-

Use the clues to complete the suitable fields.

-

Include your personal details and contact information.

-

Make sure that you choose to enter appropriate data and numbers in proper fields.

-

Carefully revise the content of your form as well as grammar and spelling.

-

Refer to Help section should you have any concerns or address our Support team.

-

Put an electronic signature on the Form 8655 printable while using the help of Sign Tool.

-

Once the form is done, click Done.

-

Distribute the prepared form via electronic mail or fax, print it out or save on your gadget.

PDF editor will allow you to make modifications in your Form 8655 Fill Online from any internet connected gadget, customize it according to your requirements, sign it electronically and distribute in several approaches.

What people say about us

How to fill out templates without mistakes

Video instructions and help with filling out and completing Form 8655