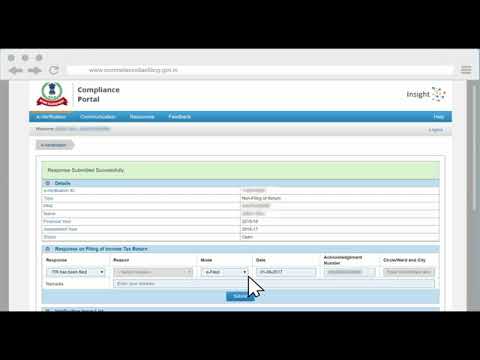

Do you know that the income tax department has launched a compliance portal to enable the verification of compliance issues such as non-filing of returns? 2. Let's see if you are required to respond to any pending compliance issues. 3. Go to compliance.inside.govt.in and click on login. 4. You will be redirected to the income-tax e-filing website. 5. Alternatively, you can directly visit incometaxindiaefiling.govt.in. 6. Once you are on the e-filing website, click on the "login here" button. 7. Enter all your login credentials, including the captcha code, and click on login. 8. Once logged in, go to "my account" and select the compliance portal beta-version. 9. Click on "confirm" and you will be redirected to the compliance portal. 10. If you have no compliance issues, then the below message will appear. 11. Otherwise, you will see pending cases for verification. 12. Click on "view" to see case details and start submitting your response. 13. If you have filed your IT return, select the response option as "ITR has been filed". 14. Fill in the date of filing the ITR and the acknowledgment number. 15. If the mode of filing ITR is paper filed, then enter the circle ward and city as well. 16. Click on "submit". 17. The department will consider the submission, and appropriate action will follow. 18. If you are yet to file your ITR, select the response as "ITR has not been filed". 19. Depending on whether you are in the process of preparing your ITR or if you think you're not liable to file ITR, choose the reason accordingly. 20. Click on "submit", and the response will be captured. 21. Kindly note that if you are an entity or person with a mandatory obligation to file ITR, the option "not liable to file return" will...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 8655 Compliance