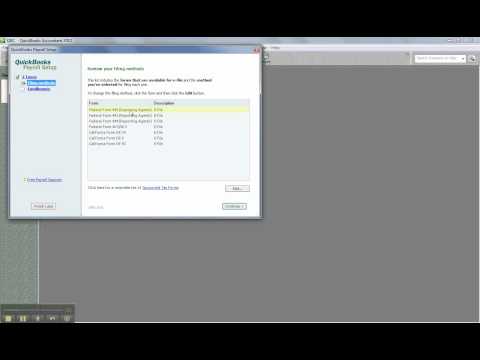

Well, everyone, welcome to this brief recorded session. We will be discussing how much easier it is going to be to be an actual filing agent or reporting agent for your clients. You will no longer have to create or apply for each company file. And I don't mean you will be batch filing, like in something you file Q from multiple company files. You will still have to do it within each company file to e-file. However, just being able to be a reporting agent and having the same five-digit pin for all company files will save you a lot of time. So, where do you go to set that up? In any file that you have, some of you have enhanced payroll for accountants. You go into the employees menu, just open up one of your client's files, and you want to go to the payroll center. In the bottom section, under related form activities, click the drop-down and choose edit filing methods. This will launch the payroll setup wizard, which was added in 2007. Now, click on filing methods. By default, it is set to print and mail, so make sure you have changed it by going in here and editing it to select e-file. You will notice a new option here to select how you want to file the 949 41-44 filing as an accountant or as a reporting agent on behalf of a client. This is new and will be different, so make sure you do this for each client. Then, go to enrollments, and here are the instructions. There are two steps. Step one is to complete form 8655, Reporting Agent Authorization, for each client whom you wish to e-file. However, if you already have your five-digit pin and have already set up to e-file,...

Award-winning PDF software

Video instructions and help with filling out and completing Can Form 8655 Payroll